CORPORATE FINANCE

goetzpartners

The art of the deal

|

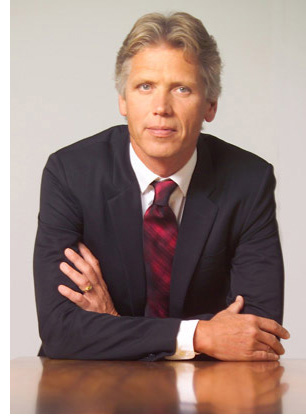

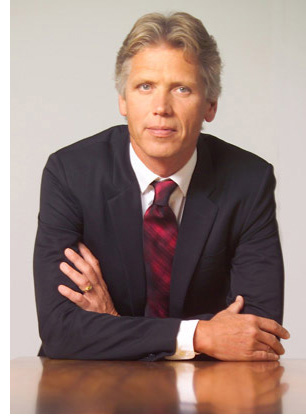

| "A knowledge-based approach is what separates the average from the excellent." —Stephan Goetz |

In any successful private equity transaction, there are three factors of importance: recognising an opportunity, understanding the interest of the stakeholders, and structuring the deal to maximise the opportunity. These are also the areas in which goetzpartners, a Munich-based specialist excels.

The origins of goetzpartners CORPORATE FINANCE GmbH go back to CEA Europe, the European arm of CEA Worldwide, the US-based corporate finance firm specialising in the telecommunication, media and technologies (TMT) sectors. Stephan Goetz, who headed CEA's European operations, was responsible for the business in Europe and for the world-wide expansion of the company. To address corporate finance opportunities in sectors other than TMT, and to offer knowledge based business consulting services, he founded TransConnect. Over the years TransConnect's business as well as CEA's European operations were significantly expanded by Stefan Sanktjohanser, who joined from Bain & Co in 1996. In 2004 the partners combined CEA Europe and TransConnect under the name of goetzpartners, to approach their markets with the concept of 'One Firm-Two Services'.

Stephan Goetz elaborates: "Now why did we do this? First, we wanted to extend our business beyond the media and telecom sectors. That is what TransConnect was about. Second, we wanted to have a knowledge base in other industries that was as deep as what we had in media and telecom, because we believe that a knowledge-based approach is what separates the average from the excellent."

goetzpartners has two distinct areas of specialisation: the corporate finance business, headed by Stephan Goetz and the management consulting business, headed by Stefan Sanktjohanser, who is also a co-founder of goetzpartners. Within the group, the services range from consulting on all types of investment activities to advice on restructuring, classical strategy and sales and marketing strategy. On the corporate finance side, the mandates range from the classical M&A business to a range of corporate finance services, from advisory, valuations and financial modelling to transaction support and strategic due diligence .

Alexander von Mellenthin, the group's COO explains: "When you look at strategic due diligence, there is always the question about what systems and what capacity an investor has in place to conduct all the relevant research and analysis. Take the case of privately held companies in Germany. As the disclosure requirements for unlisted companies are less stringent than in the UK or the US, it is not easy to get information beyond the publicly available financial and company data. This becomes apparent when one is assessing an acquisition, divestment or buyout candidate. In such cases, where information is sparse, our focus shifts to identifying those 'invisible' factors that allow our clients to 'see' what others cannot see, and thus not only win the deal, but add value over the holding period of the investment. This is one of our key advantages. Our people are so deeply involved in the industries and sectors in which we are active that we can combine our in-house expertise with sector-specific knowledge, industry contacts and network to create a strategy which our competitors are hard pressed to match."

"For instance," says Goetz, "take the example of KDG, the German cable company. How were Apax, Providence and Goldman Sachs—whom we advised on buying it from Deutsche Telecom—able to pay back the loans faster than the planned period? For one, they had a superior understanding of the business they were investing in. And second, if you look at the deal, their knowledge was at least equal to that of the seller. Knowledge is always the key, not only during the initial stages for evaluating a business but also during its subsequent development. Providing such knowledge is what differentiates us from many of our global competitors. For instance, in the major investment banks, the HQ defines certain products and services and then they are pushed world-wide. We, on the other hand, need to be much more innovative and need to re-think our strategy constantly. To this end we have very flat hierarchies, meaning anyone who has a good idea-whether he is an associate or a managing director-is heard. Anyone can run a project here, it is not a matter of where you are in the organisation. And second, we often sit together and discuss ideas and new concepts. We believe that creativity and creative dialogue is what makes us different. Communication is a key element at goetzpartners and, there is a lot of cross-fertilisation and synergy.

This open culture reflects in the company's achievements. For many of its clients, goetzpartners has done deals which have literally redefined the fundamentals of deal-making. In 2000, during the hey-day of the telecom boom, the firm was given a mandate by HT Stritzl, the owner of ewt/tss, the fourth largest independent German broadband cable operator, to implement a suitable strategy: a floatation, merger or sale. Leveraging the market sentiment, goetzpartners (the former CEA) advised on the sale of the company to UPC, a Dutch cable operator, at the highest ever EBITDA multiple in German cable's history. The deal also included an obligation of a couple of hundred million euros. Two years later UPC filed for Chapter 11 protection. During the subsequent restructuring of UPC, goetzpartners advised the Stritzl family to buy back the assets it had sold, in lieu of the obligation, at the lowest EBITDA multiple in German cable's history. So in July 2002, the Stritzl family regained control of ewt/tss and also kept the original amount they had received for it. In a way this is like having your cake and eating it too.

Says Goetz: "To be honest, Mr Stritzl is a genius. The way he waits for his opportunity is just remarkable. And to work with someone like him is extremely satisfying for us. We give him the ideas, we do the risk analysis and lay the groundwork for him to make his moves. The ultimate decision however, is his. This is what I call an entrepreneurial mind."

The reason why such clients choose goetzpartners is simply a matter of performance and the ability to deliver. For some of the bigger deals that go into multiples of billions however, it makes sense to have one of the big investment bankers run the show. In such scenarios, where there are a lot of public sources of information and the deal is basically an exercise in financial engineering, there is little competitive advantage that goetzpartners has over bigger rivals.

"This has compelled us", explains Goetz, "to go for more complicated deals both on the sell-side and on the buy-side. Such deals are typically valued up to several hundred million euros and rarely go into the billions. Now when we take a buy-side mandate, we carry a disproportionate risk, because a large part of our compensation is success-based. How can we survive such a disproportionate risk? If you look at the principles of evolution, you will see that those creatures that take disproportionate risks need to have extraordinary abilities, otherwise they are a non-proposition to nature. Now the abilities that put us in the running, even when burdened with disproportionate risks, are exceptional knowledge and tools. And that is what we have done. We have looked at how we can build on our strengths and develop a body of knowledge for our clients that is superior to other bidders."

|

"We identify those 'invisible' factors

that allow our clients to 'see' what others cannot see." —Alexander von Mellenthin

|

"For sell-side clients," he adds further, "we often advise them on a divestment. And sometimes, if they only take the advice of a leading investment bank, which is true for some of them, then we basically ask for an opportunity to come in with one or two suitable buyers, and if that doesn't work then they can always go and do an auction with an investment bank of their choice. But we give an opening that we believe would be more appropriate and profitable than an auction. Take the divestment of Lagardère's outdoor advertising business. At that time, Jean-Luc Lagardère wanted a leading investment bank to represent the sale. And I asked him if we could handle it. He replied that it wouldn't make sense as our company was not known well enough in France. In turn I asked him how much time he would give me and what was his asking price. My objective was to get him a suitable offer within that time frame. I told him that in case I didn't succeed, he could always hire a 'well known' investment bank. He agreed and told me what he wanted. It was a substantial amount of x billion French francs and I had five weeks to get a suitable offer. Within the divestment package there was also a radio station called Skyrock. We then selected Deutsche Morgan Grenfell as a suitable buyer. The deal went through at Lagardère's asking price. Ten months later we advised on the sale of the company, excluding the radio station, to Viacom for Lagardère's x billion francs plus an extraordinary premium. In fact, we nearly doubled the investment in less than a year and got a radio station to spare."

Says Mellenthin: "Deals also develop the other way around, where we advise buyers such as private equity funds, who are interested in buying a particular company."

"For instance," adds Goetz, "when we got the mandate to advise on the acquisition of Gardena, Goldman Sachs was the advisor to the selling families. When we selected IndustriKapital to bid during the auction, it was done after a relatively complex analysis of several inter-related factors, which included not only the interests of the selling families, but also factors that would support a co-operative and productive relationship between the buyer and Gardena's management team participating in the buyout. In a different example, when Cerberus acquired GSW, a Berlin-based housing company for €1.97bn, we convinced Cerberus to work with HSH-Nordbank, which was a winning factor in enabling Cerberus to close the deal successfully. HSH-Nordbank has an excellent reputation in German residential real estate not only as a financing source but also for its managerial skills. When we choose the players in a transaction, the first question is: which ones are the most appropriate for the needs of our client? So you not only have to know the asset to be successful, but you also have to understand the funds and the people running them to skilfully match the investors and the investee."

|